Background photo created by ijeab – www.freepik.com

Today, I’ll cover 3 false beliefs about money and finances that you must break away from in order to achieve mastery over your money. Getting your mindset right is the #1 thing you have to conquer if you want to succeed in anything. As the popular saying goes, “You are your worst enemy and best asset”. 😉

After working with many people from all walks of life, I can tell you that the best and most successful clients are those with the right mindset and attitude. Those who are open to changing their beliefs about money and finances. It’s myth-busters time. Let’s re-align your perspectives.

#1: "Budgeting is only for nerds and people who are broke”

This is a common myth that couldn’t be further from the truth.

If you ask people whether or not they budget, you’ll usually find that those in debt are the ones that don’t – not the other way around!

It’s common to think that budgeting is for nerds who enjoy working with numbers. Well, I don’t consider myself a nerd but I DO love having a sense of financial security and smashing my financial goals! I’m actually no expert with numbers which is why I let the Spending Planner Software take care of the calculations for me.

Perhaps you see yourself as a “free spirit” who doesn’t want to feel restricted. However, this may lead you impulse buying and overspending. A budget isn’t meant to crush your free spirit. It lets you enjoy some impulsiveness without going into debt in the process.

The thing is that budgets (aka spending plans) are for everyone, no matter how much money you earn or the size of your bank balance.

Contrary to what you may think, in his study of millionaires, Thomas Stanley found that the vast majority of wealthy people DO budget. (His bestselling book, “The Millionaire Next Door”, identifies common traits among those who have accumulated wealth and is worthwhile reading).

Making a lot of money is a great start to building your wealth but managing your money responsibly is what actually gets you there.

I have had clients earning high six figure incomes every year. These people live affluent lifestyles (huge homes in exclusive areas, private schools, designer clothes, expensive cars, overseas holidays, boats, etc.) and outwardly they appear to be wealthy. But they come to me for help because they’re stressed about money, drowning in credit card debt and have very little in savings. They have the same money issues as everybody else, just on a bigger scale!

A budget (or spending plan) is simply a plan for your money that focuses on the future. Yes, you need to be able to see exactly what money you have coming in and going out each month. But more importantly, if you have financial goals (such as a family holiday every year, a home, a new car, a retirement fund) a budget will make sure that you actually achieve them.

#2: "I use my credit card for emergencies"

This is a pet peeve of mine.

Credit cards are great if used wisely – that is paying out the balance in full every month. But they’re no substitute for emergency savings!

When you use your credit cards as your emergency fund, this spending becomes debt that you’ll eventually have to repay. If you don’t have the extra income to handle the debt, you’ll find it very hard to pay down the balance. What’s more, the high interest rates on credit cards means you’ll also be paying dearly for the privilege of having that debt!

Make it a priority to start building an emergency savings fund so when the unexpected happens you can avoid putting those expenses on your credit card.

Now, there may be times when a significant event occurs and you don’t have enough saved. In this situation a credit card can absolutely help.

But don’t rely solely on your credit card as a replacement for emergency savings. In the words of motivational speaker and author Denis Waitley – “Expect the best, plan for the worst, and prepare to be surprised”.

I have personally had customers who couldn’t see how they could build their savings who still made it work, so I know that you can too!

#3: “I can save later”

I can understand why someone would believe this as I’ve been there myself.

When we’re young it’s easy to think that we have all the time in the world and retirement seems a long way off. We want to enjoy life and spend money (YOLO – You Only Live Once).

Yes, enjoy life. And yes, it’s ok to spend money. But NOT to the detriment of future you.

I’ve seen time and again older people who wished they’d started saving sooner. Why? Because of the power of compound interest (earning interest on the interest you receive).

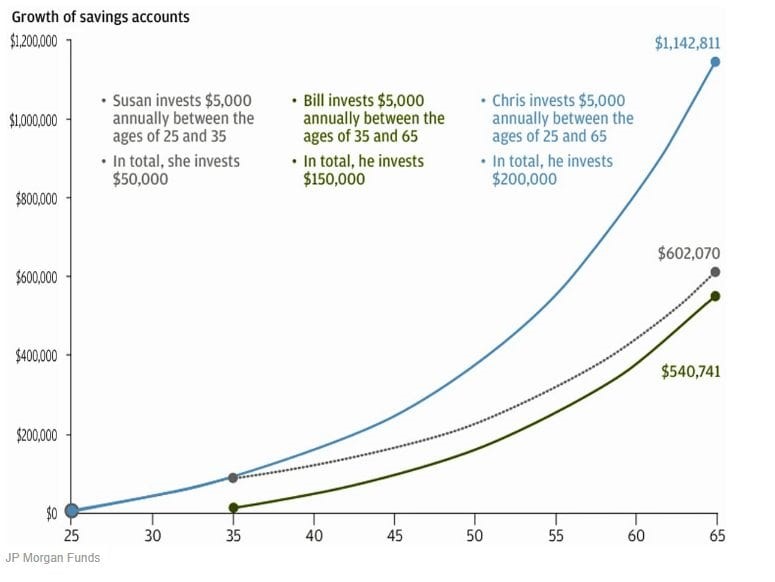

The thing is, the power of compound interest is unleashed only with time. The earlier you start saving, the better. Either the shorter the time you have to devote to saving money, or the less money you have to save over time. Look at these examples (assumes a growth rate of 7%):

The main takeaways here are:

- All three invest the same amount of money annually but the difference is Susan starts investing at the age of 25 (and then stops after 10 years) and Bill starts at the age of 35 and invests until retirement. So, Susan’s 10 years of investing ($602,070) beats Bill’s 30 years ($540,741)!

- Chris ends up with more than double Bill’s money even though Chris invested only $50,000 more in total.

It’s time to throw out the excuses and save as much as you can as early as you can and you’ll be much better off.

Why is believing in these 3 myths problematic?

Because believing in these 3 myths will stop you from taking action, the right action. Your confidence gets affected, you don’t seek help, and subsequently, you don’t transform your life and business as a result.

As someone who does money management for a living, I have seen breakthrough after breakthrough and I know that it’s not difficult to win with money, people just don’t have the right guidance and support to succeed.

Many people search for information online fruitlessly, and when that doesn’t work, they give up. I don’t want you to give up because I know you can do this!

If it’s so hard, how are there millions of people who’ve achieved financial freedom? So, are they are all geniuses? No … they did it by getting the right help and putting in the work! So take heart. Don’t for a second doubt yourself.

For a FREE consultation, click here and schedule a time for us to talk about your money frustrations and goals.